Contribution Per Unit Formula

12 x 15000 units Looking at the contribution per unit above 12 you should be able to see that it can be increased by. But anyway lets go back to our bakery and see what those 80 per cake mean.

Contribution Margin Ratio Revenue After Variable Costs

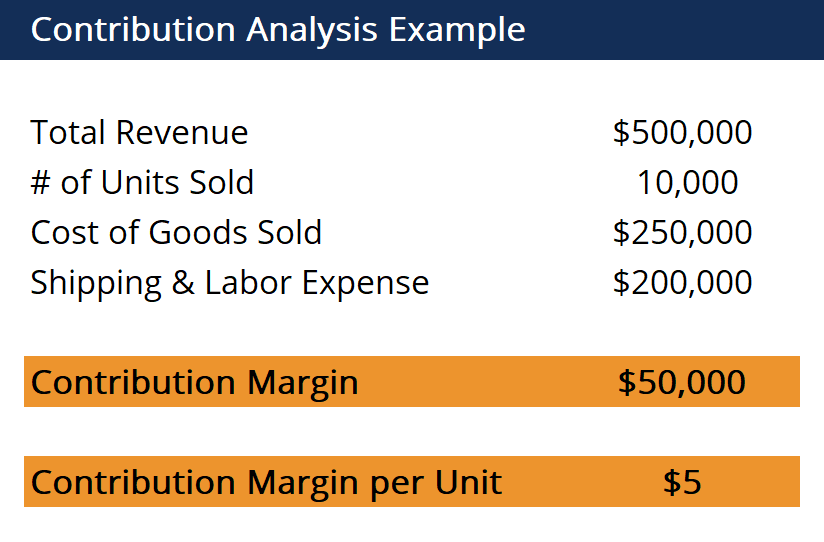

For example a company sells 10000 shoes for total revenue of.

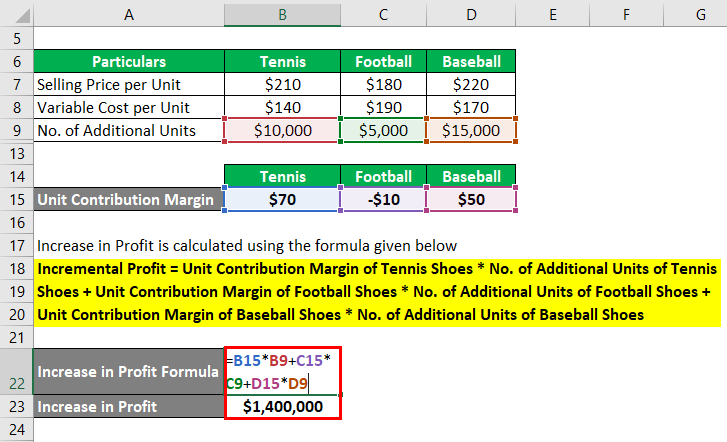

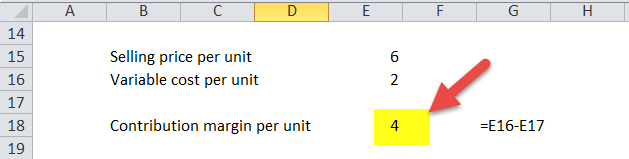

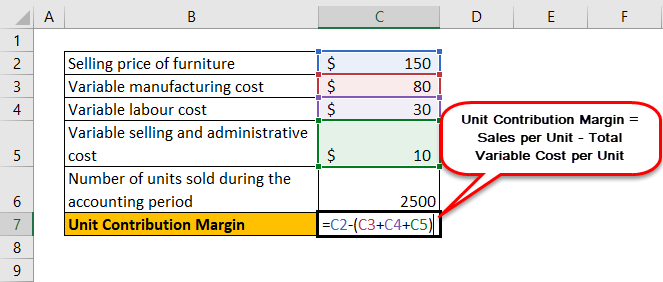

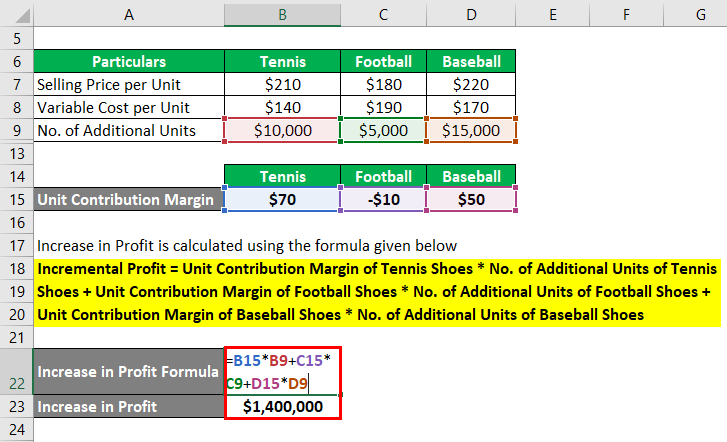

. Contribution margin is a cost accounting concept that allows a company to determine the profitability of individual products. The formula for unit contribution margin is fairly simple and it can be expressed as the difference between the selling price per unit and the total variable cost per unit. Contribution represents the portion of sales revenue that is not.

Total revenue variable costs of units sold. Contribution margin per unit formula would be Selling price per unit Variable cost per unit Variable. The 80 contribution margin means that whenever we sell a cake we get a margin.

Total revenues total variable costs Total units Contribution per. Break-Even Point units Fixed Costs Revenue Per Unit Variable Cost Per Unit To calculate break-even point based on sales in GBP. Also you can use the contribution per unit formula to determine the selling price of each umbrella.

What is the formula for calculating a contribution per unit. The variable cost per unit is 2 per unit. The formula for contribution margin dollars-per-unit is.

The selling price per unit is 100 incurring variable manufacturing costs of 30 and variable sellingadministrative expenses of 10. For example a company sells 10000 shoes for total revenue of 500000 with a. Divide your fixed costs by the contribution margin.

Now the selling price per unit of an umbrella was 20. Total revenue variable costs of units sold. Alternatively it is known as the contribution to sales ratio or Profit Volume ratio.

The number of units sold was 50000 units. The contribution margin formula is quite straightforward. The Contribution Per Unit represents the incremental money generated for each productunit sold after deducting the variable portion of the firms costs is calculated using Contribution Margin.

The Revenue from all muffins sold in March is. As a result contribution per unit is calculated as follows. The formula for contribution margin dollars-per-unit is.

All you have to do is multiply both the selling price per unit and the variable costs per unit by the number of units. The contribution margin ratio shows a margin of 60 600010000. But this same café also sells muffins.

As a result the contribution margin for. Contribution 180000 ie. This ratio represents the percentage of.

That sounds like a good result. The phrase contribution margin can also refer to a per. Contribution margin CM or dollar contribution per unit is the selling price per unit minus the variable cost per unit.

We can represent contribution margin in percentage as well.

Contribution Margin Formula And Ratio Calculator Excel Template

Contribution Margin Meaning Formula How To Calculate

Unit Contribution Margin Meaning Formula How To Calculate

Contribution Analysis Formula Example How To Calculate

Unit Contribution Margin How To Calculate Unit Contribution Margin

Comments

Post a Comment